Welcome to National Apprenticeship Week

National Apprenticeship Week

National Apprenticeship Week is an opportunity for us to celebrate the achievements of our apprentices and the positive impact they make to employers, businesses, and the wider economy. The week will have something for everyone. We will hear personal stories from apprentices and employers about their own journeys and experiences and why apprenticeships provide the #SkillsForLife. There will be workshops, competitions, events, job fairs and more.

Use the below menu to navigate the page:

- Apprentice Snapshots

- Apprentice Case Studies

- Did You Know? Statistics

- Live Apprenticeship Vacancies

- Apprentice and Employer Quotes

- The Day in the Life of an Apprentice

Take a look at our 'About Apprenticeships' page to see what Apprenticeship training we currently offer.

You can also head on over to the official National Apprenticeship website [external link] for useful videos, resources, FAQs and lots more.

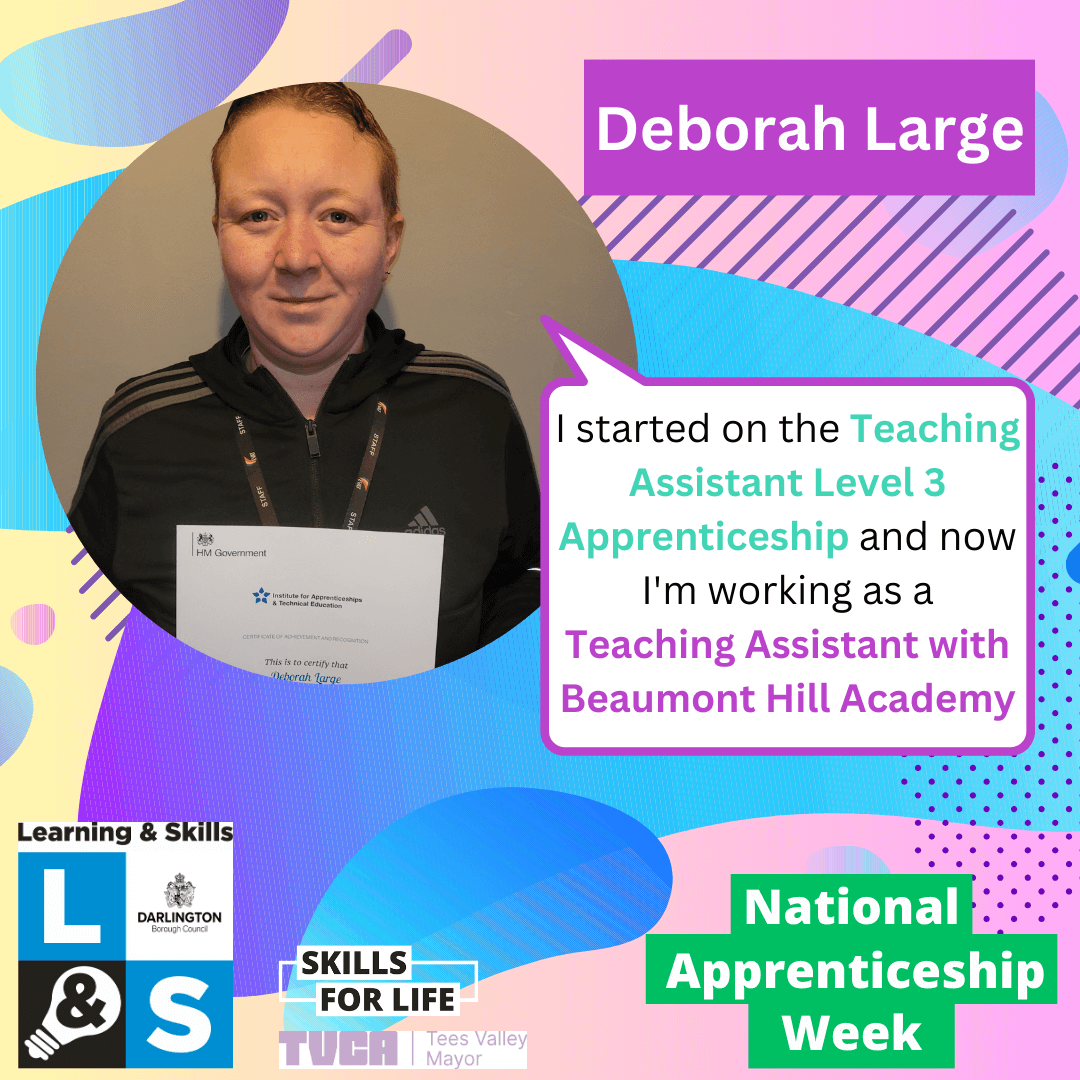

"I started on the Teaching Assistant Level 3 Apprenticeship and now I'm working as a Teaching Assistant with Beaumont Hill Academy"

Deborah Large

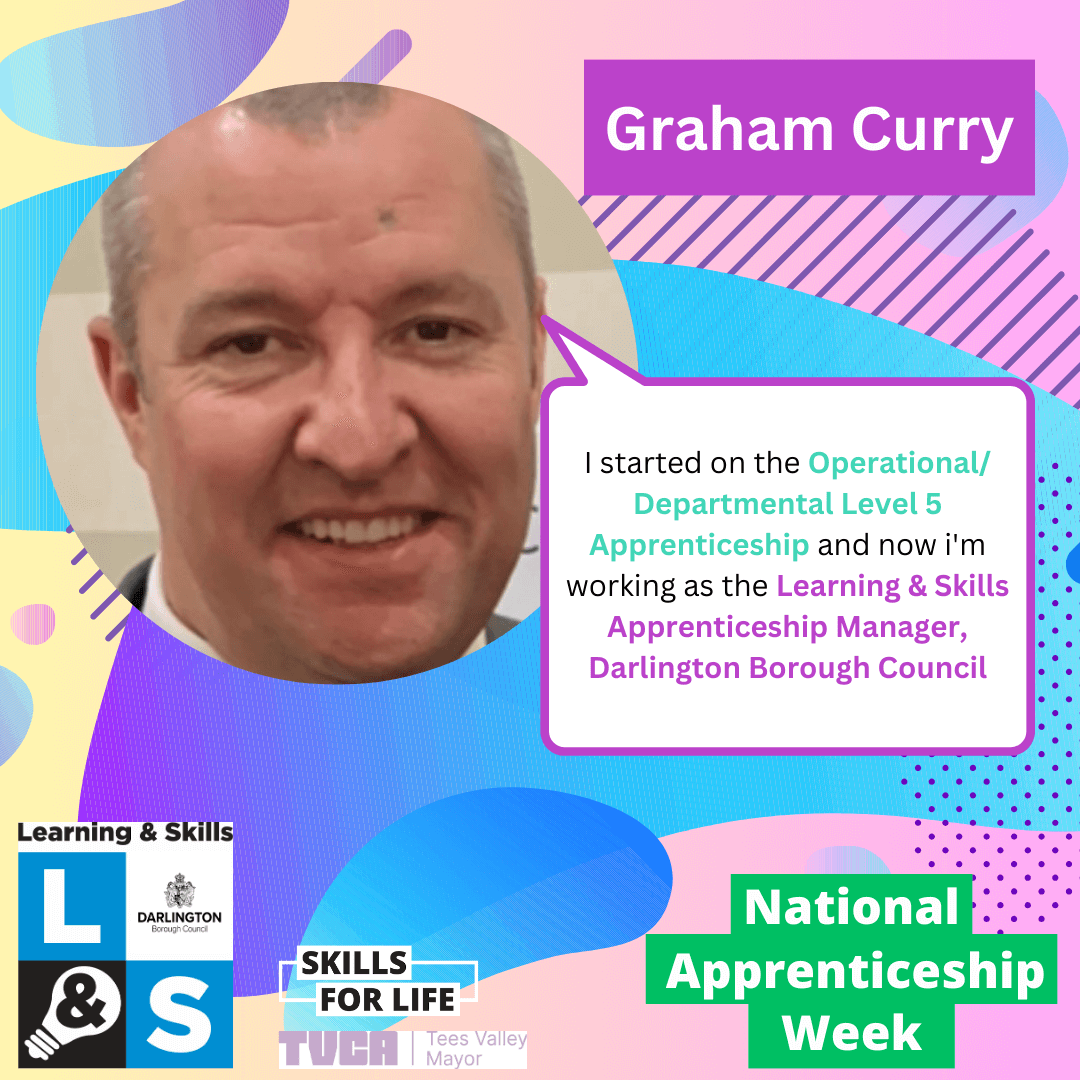

"I started on the Operational/Departmental Level 5 Apprenticeship and now I'm working as the Learning & Skills Apprenticeship Manager, Darlington Borough Council"

Graham Curry

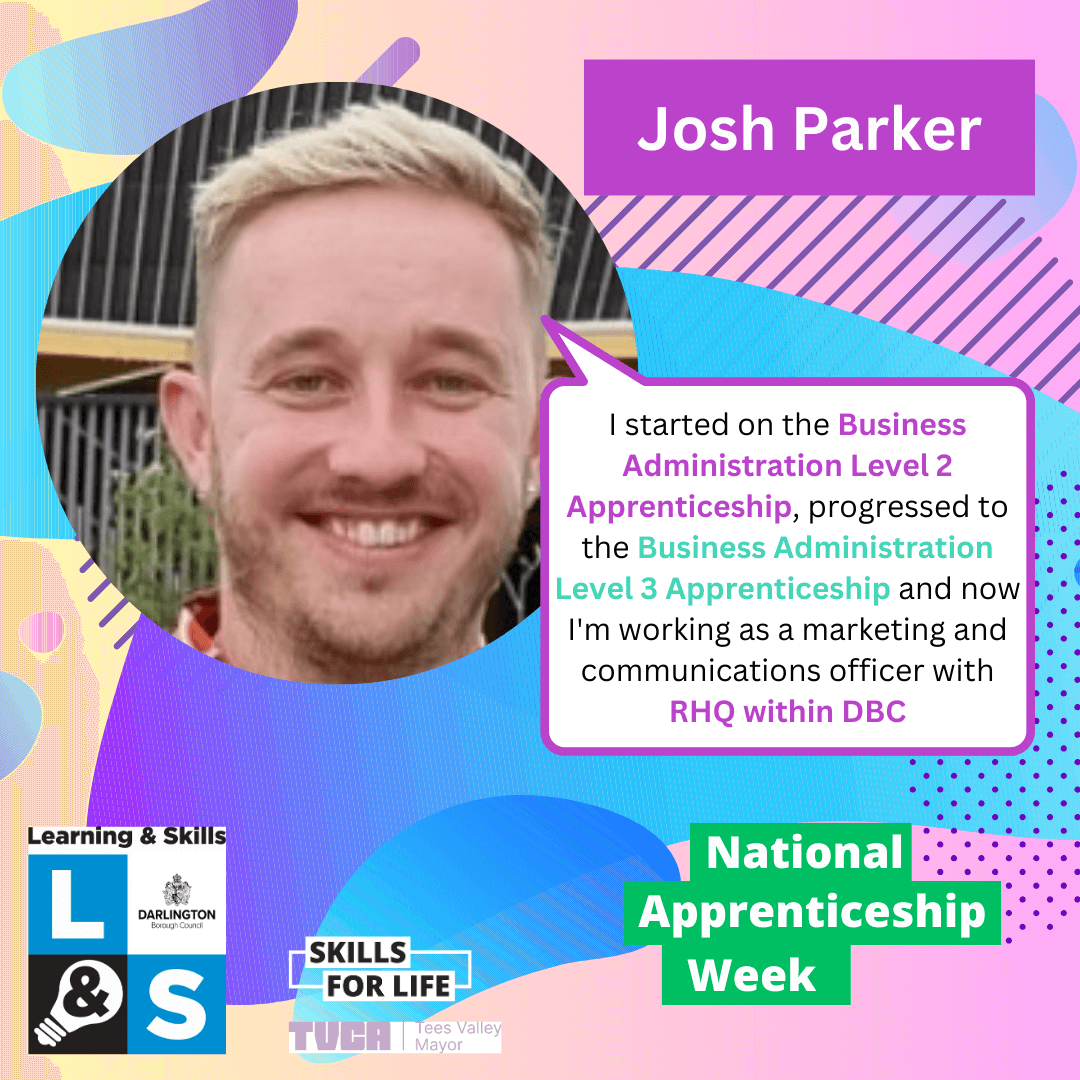

"I started on the Business Administration Level 2 Apprenticeship, progressed to the Business Administration Level 3 Apprenticeship and now I'm working in marketing and communications with the Heritage Quarter, Darlington"

Josh Parker

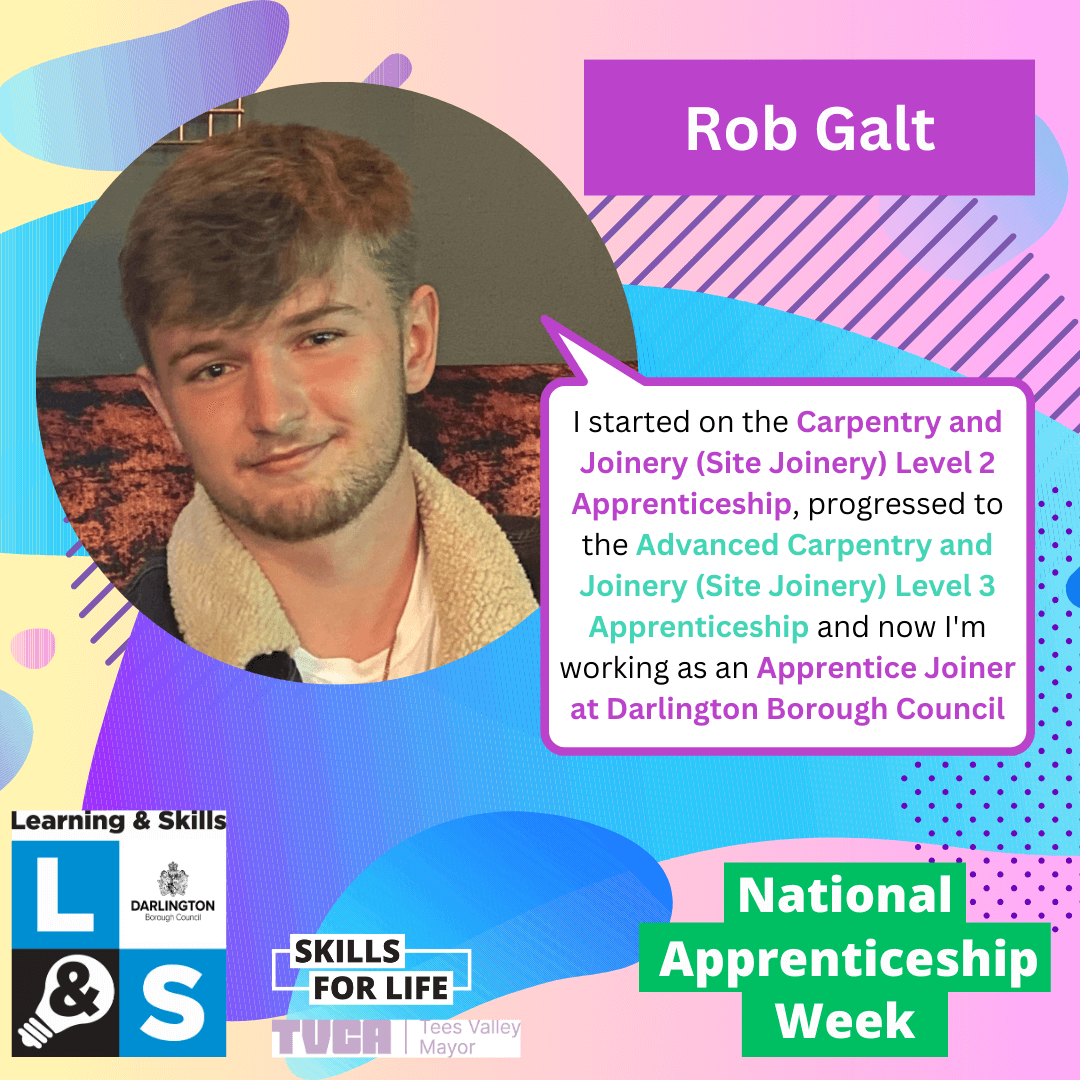

"I started on the Carpentry and Joinery (Site Joinery) Level 2 Apprenticeship, progressed to the Advanced Carpentry and Joinery (Site Joinery) Level 3 Apprenticeship and now I'm working as an Apprentice Joiner at Darlington Borough Council"

Rob Galt

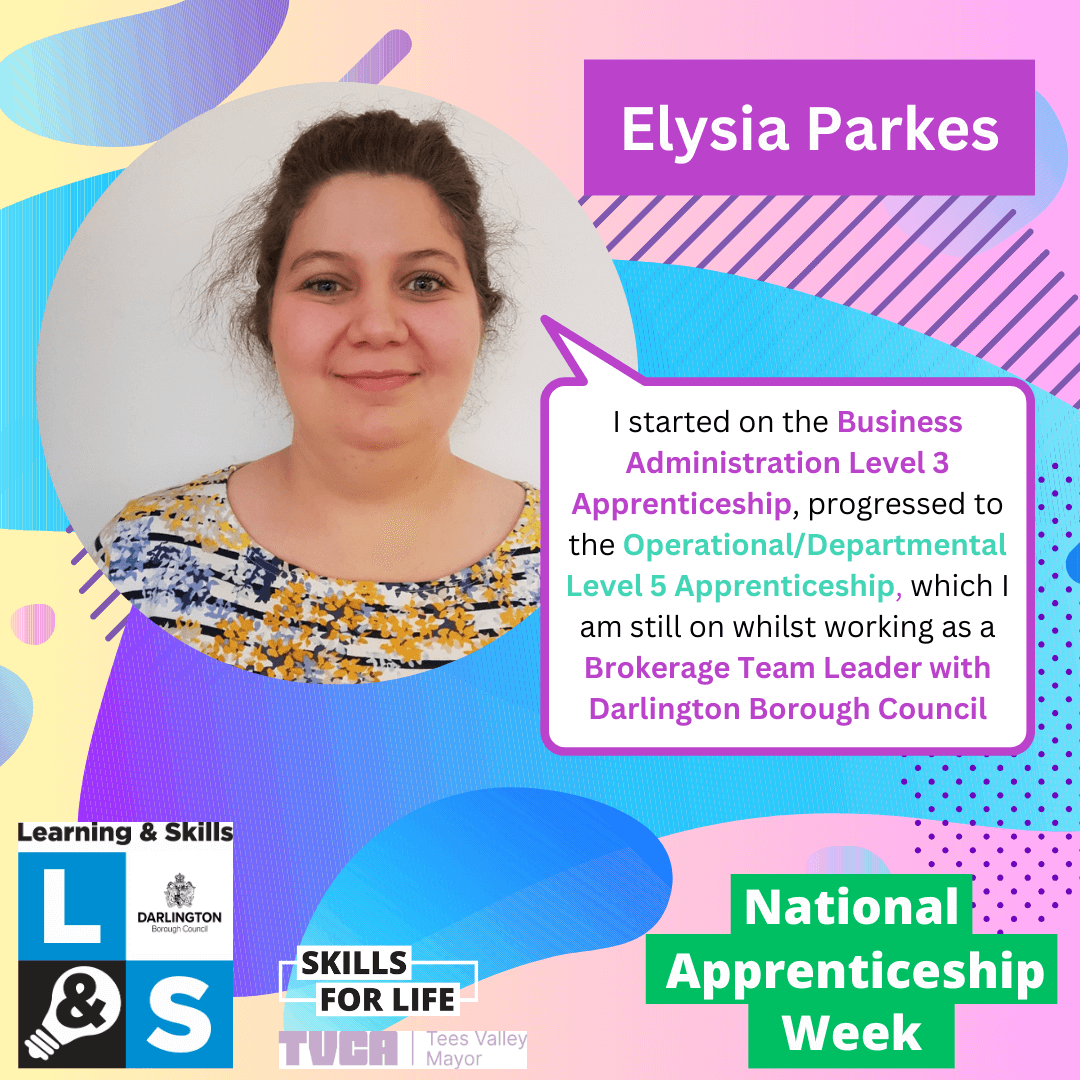

"I started on the Business Administration Level 3 Apprenticeship, progressed to the Operational / Departmental Level 5 Apprenticeship, which I am still on whilst working as a Brokerage Team Leader with Darlington Borough Council"

Elysia Parkes

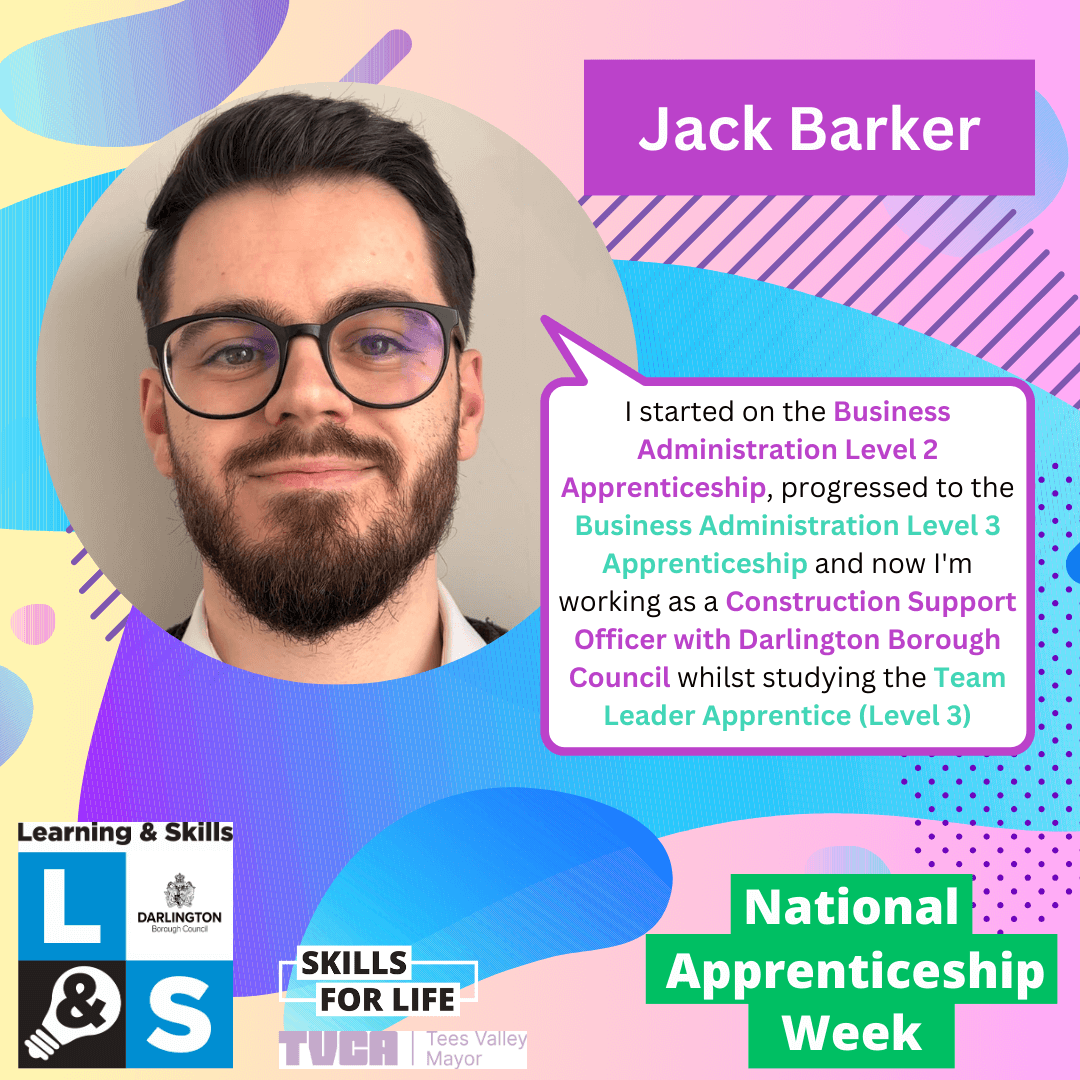

"I started on the Business Administration Level 2 Apprenticeship, progressed to the Advanced Level 3 Apprenticeship and now I'm working as a Construction Support Officer with Darlington Borough Council whilst studying the Team Leader Apprentice (Level 3)"

Jack Barker

Callum McFarland[pdf document], Customer Service

Mario Krupa[pdf document], Motor Vehicle

Jack Baker[pdf document], Business Administration

Tammy Firth[pdf document], Operational/Departmental Manager

Graham Curry[pdf document], Operational/Departmental Manager

Siobhan Howdle[pdf document], Teaching Assistant

Abigail McDade[pdf document], Business Administration

Hannah Norrie[pdf document], Business Administration

Olga Pripasu[pdf document], Business Administration

Meg Horsburgh[pdf document], Business Administration

Tom Nogrove[pdf document], Early Years Educator

Rebecca Bowers[pdf document], Business Administration

Lee Caygill[pdf document], Motor Vehicle

Rob Galt[pdf document], Carpentry and Site Joinery

Elisia Richardson[pdf document], Business Administration

Did you know?

We currently work with 91 apprentices and 44 employers!

Did you know?

83% of our apprentices achieved their qualification! That's 20% above the national average!

Did you know?

82% of our apprentices achieved their qualification on time! That's 19% above the national average!

Did you know?

Our apprentices had a 97.3% attendance rate.

Head on over to our live vacancies page! You'll find amazing apprenticeship roles with employers across Darlington, Teesside, County Durham and North Yorkshire. Remember, all application must be made through the 'Find an Apprenticeship' website.

Apprentices must be paid at least the National Apprenticeship Wage. Apprentices must be employed, with a contract of employment to cover the duration of the apprenticeship for a minimum of 30 hours per week (maximum of 40).

| Apprentice Age | Government Grant |

|---|---|

| 16-18 | £6.40, this will be revised in April 2025. If the apprentice is aged 19+ after 12 months this must raise to the National Minimum Wage for their age. |

| 19+ |

£6.40, this will be revised in April 2025. This would rise to the National Minimum Wage for their age after 12 months. |

If you're not sure which vacancy is right for you, you can apply for a general apprenticeship area (for example, Customer Service). This will place you into a pool of candidates and we will try to match you with any new and relevant vacancies that pop up.

"I enjoy my apprenticeship because it enables me to learner new skills to take into my career. I enjoy learning new things and like the people that I work around. The staff at DBC and Learning & Skills all help and enable me to move further on my course and with my career. This helps to improve my attitude towards my job and drives me to do better."

Joe Yellow - Apprentice

"I chose to do an apprenticeship as I am a practical learner and my course has helped me do this. The Learning & Skills centre has supplied me with all the skills and resources I need and helped me to pass my level 2 apprenticeship and move onto the level 3 qualification."

Robert Galt - Apprentice

"The best way of learning about an apprenticeship is by doing it and having a go."

Louise Beal - Apprentice

“EARN.LEARN.QUALIFY”

Tallula Selby Willis - Apprentice

“Learning & earning, there is no experience like on the job learning”

Eve Parkinson - Apprentice

"Our apprentices have been an invaluable resource for the company and have helped us to address many key administration functions within the firm as we grow from the post-pandemic climate. It has been incredibly rewarding to the see our apprentices developing and maturing within their roles, taking responsibility and, ultimately, becoming important members of our team."

Latimer Hinks - Employer

"The apprenticeship to me is an amazing opportunity to gain skills and knowledge in a supportive and accessible environment. It allows me to work on my development with a trainer who gets it, knows her stuff and genuinely wants us to enjoy the learning process."

Michelle McIntyre - Apprentice

"Offering Apprenticeships to staff, during normal working hours, has given us the opportunity to show a commitment to developing skills relevant to their job role and motivate staff into learning new skills.

Upskilling current staff through Apprenticeships has helped improve the quality of the organisation, retain valuable staff, and highlighted they are a major part of our future. In life you are always learning, and you are never too old to start an Apprenticeship to further develop your knowledge, skills, and behaviours."

Graham Curry - Learning & Skills Darlington

- Eleigha Bramley[pdf document], Early Years Educator

- AM[pdf document], Business Administration

- JG[pdf document], Business Administration

- Jodie Burlinson[pdf document], Business Administration

- Kelvin McDade[pdf document], Operational/Departmental Manager

- Rob Galt [pdf document], Carpentry and Site Joinery

- James Kelly[pdf document], Carpentry and Site Joinery

- Joe Yellow[pdf document], Carpentry and Site Joinery

- Callum Parkinson[pdf document], Motor Vehicle

- Kieron Lazenby [pdf document], Motor Vehicle

- Brandon Temple[pdf document], Motor Vehicle